One of the greatest economists in the 20th century passed away at the age of 102. His ideas of transaction costs and property rights revolutionized modern economics and altered the way economists thought about markets, firms, institutions, laws, governance, regulations and many more.

2013 is a bad year for new institutional economics, we already lost another great thinker, Armen Alchian, in February this year.

RIP, professor.

Observable and Verifiable

Without Quest for Knowledge, Life Would Be a Mistake

Monday, September 2, 2013

Friday, July 19, 2013

Bringing REAL Markets Inside the Firm

Eddie Lampert, CEO of Sears has brought real markets inside one big firm. The results? Disastrous. As Bloomberg Businessweek put it, he really tried to replicate Oakland A's success story in Moneyball, but in fact, he was running his firm like a Hunger Game.

Thursday, April 25, 2013

The Nerdy vs. The Powerful, says Colbert

Three economists from the University of Massachusetts, Amherst recently published a paper, claiming they have found an uncommon spreadsheet coding error in a famous AER paper, 'Growth in a Time of Debt', coauthored by Harvard economists Carmen Reinhart and Kenneth Rogoff. This immediately went viral since the key finding in Reinhart and Rogoff's paper had already become some politicians' cannonball in order to fire pro-austerity plans across the US and the Europe. Specifically, R-R have found that, on average, a greater than 90% debt to GDP ratio would lead to a growth rate of -0.1%. But according to the critics, the authors haven't taken the averages right in their Excel spreadsheet, and the correct number should be 2.2% instead of -0.1%, which is far from stagnation. Later, R-R offered their responses, twice - first rebutting all the critiques but then admitting the coding error while rebutting the rest (here is a nice summary of the entire episode).

I bought most of their second response, yet I still think their Excel error was dumb. Besides, if it were 2.2% rather than the eye-dazzling -0.1%, I would doubt they could ever publish it in the first place. Although Reinhart and Rogoff referred to their JEP piece where they've shown similar results of negative correlations, I still believe what really caught the eyes of economists as well as politicians was the magnitude of that correlation, particularly when the debt-to-GDP ratio passes the 90% threshold.

Interestingly, adding new flavor to this debate is neither economists (see here and here) nor politicians but comedian host Stephen Colbert. He took on this debate yesterday and turned it into something hilarious, something epic. He brought onto the stage one of the critics from UMass, an econ grad student Thomas Herndon, and shouted at these "left-leaning academi-aholes", "nerds! I bet you found them [the errors] on a Friday night with your mom, while the rest of us were going up to The Point and drinking PBR!"

I bought most of their second response, yet I still think their Excel error was dumb. Besides, if it were 2.2% rather than the eye-dazzling -0.1%, I would doubt they could ever publish it in the first place. Although Reinhart and Rogoff referred to their JEP piece where they've shown similar results of negative correlations, I still believe what really caught the eyes of economists as well as politicians was the magnitude of that correlation, particularly when the debt-to-GDP ratio passes the 90% threshold.

Interestingly, adding new flavor to this debate is neither economists (see here and here) nor politicians but comedian host Stephen Colbert. He took on this debate yesterday and turned it into something hilarious, something epic. He brought onto the stage one of the critics from UMass, an econ grad student Thomas Herndon, and shouted at these "left-leaning academi-aholes", "nerds! I bet you found them [the errors] on a Friday night with your mom, while the rest of us were going up to The Point and drinking PBR!"

Saturday, April 20, 2013

Bless Sichuan, bless Ya'an!

Yesterday around 8am local time, a devastating earthquake struck the city of Ya'an in western Sichuan province. At the time, I was still in bed at home in the city of Mianzhu, which is about 100 miles away from the epicenter. The tremor hit so violently that I rushed downstairs without second thought.

According to the public media, the magnitude and impact of this earthquake to Sichuan and China is second only to the Great Sichuan Earthquake (aka Wenchuan Earthquake) 5 years ago. Experts said that both quakes occurred along the same geological fault. So far, over 170 people lost their lives and more than 5,000 were injured. Let's bless everyone in Ya'an and Sichuan!

According to the public media, the magnitude and impact of this earthquake to Sichuan and China is second only to the Great Sichuan Earthquake (aka Wenchuan Earthquake) 5 years ago. Experts said that both quakes occurred along the same geological fault. So far, over 170 people lost their lives and more than 5,000 were injured. Let's bless everyone in Ya'an and Sichuan!

Tuesday, March 5, 2013

The World's First Modern Organization Chart

Business historian Alfred Chandler Jr. (1918-2007) once wrote in one of his most influential works, The Visible Hand, about the momentous impact of managerial innovations, such as corporate accounting, mass production, and the organization chart. From there, he even identified the world's first modern organization chart and described its impacts in granular details.

According to Chandler, the first modern organization chart is the New York and Erie Railroad pioneering plan created by it's manager Daniel McCallum and his associates. The purpose of the plan was to facilitate information flow from the bottom of the organization to its top in an age when the adoption of telegraph had largely increased the scale of the railroad as well as its managerial complexity. However, in none of Chandler's works had we actually seen what the chart looked like. In fact, as later revealed by Chandler in an HBR article published in 1988, "I have never seen a copy of McCallum's chart, but it was described in some detail by Henry Varnum Poor, editor from 1849 to 1861 of the American Railroad Journal. According to Poor, the chart resembled a tree. Its roots represented the president and the board of directors. Its branches were the five operating divisions and the passenger and freight departments. Its leaves indicated the various local ticket and freight agents, crews and foremen, and so on."

But the real curious question is, of course, what does the world's first modern organization chart look like? Caitlin Rosenthal, a postdoctoral fellow at the Harvard Business School finally found out (see below and enlarged here) - and as Chandler already told us, it's really not quite resemble the top-down, pyramid style chart we now see everyday, it's more like a tree and it's bottom-up.

According to Chandler, the first modern organization chart is the New York and Erie Railroad pioneering plan created by it's manager Daniel McCallum and his associates. The purpose of the plan was to facilitate information flow from the bottom of the organization to its top in an age when the adoption of telegraph had largely increased the scale of the railroad as well as its managerial complexity. However, in none of Chandler's works had we actually seen what the chart looked like. In fact, as later revealed by Chandler in an HBR article published in 1988, "I have never seen a copy of McCallum's chart, but it was described in some detail by Henry Varnum Poor, editor from 1849 to 1861 of the American Railroad Journal. According to Poor, the chart resembled a tree. Its roots represented the president and the board of directors. Its branches were the five operating divisions and the passenger and freight departments. Its leaves indicated the various local ticket and freight agents, crews and foremen, and so on."

But the real curious question is, of course, what does the world's first modern organization chart look like? Caitlin Rosenthal, a postdoctoral fellow at the Harvard Business School finally found out (see below and enlarged here) - and as Chandler already told us, it's really not quite resemble the top-down, pyramid style chart we now see everyday, it's more like a tree and it's bottom-up.

Friday, December 28, 2012

The value of bosses

A firm could be productive because its workers are highly productive, or it has a productive technology, or maybe because it has good bosses who are capable of enhancing the productivity of the workers. But how much could good bosses matter, really? It's hard to tell, since it's not easy to tease out one effect from another. But it's not impossible to tell either, as long as you have exact the right (and often large) data set to begin with. A recent study just did this, and they find out that good bosses could lead to about 10% increase in productivity for a given worker.

Here is the abstract:

Here is the abstract:

Do supervisors enhance productivity? Arguably, the most important relationship in the firm is between worker and supervisor. The supervisor may hire, fire, assign work, instruct, motivate and reward workers. Models of incentives and productivity build at least some subset of these functions in explicitly, but because of lack of data, little work exists that demonstrates the importance of bosses and the channels through which their productivity enhancing effects operate. As more data become available, it is possible to examine the effects of people and practices on productivity. Using a company-based data set on the productivity of technology-based services workers, supervisor effects are estimated and found to be large. Three findings stand out. First, the choice of boss matters. There is substantial variation in boss quality as measured by the effect on worker productivity. Replacing a boss who is in the lower 10% of boss quality with one who is in the upper 10% of boss quality increases a team’s total output by about the same amount as would adding one worker to a nine member team. Using a normalization, this implies that the average boss is about 1.75 times as productive as the average worker. Second, boss’s primary activity is teaching skills that persist. Third, efficient assignment allocates the better bosses to the better workers because good bosses increase the productivity of high quality workers by more than that of low quality workers.Source: Freakonomics Podcast.

Thursday, November 29, 2012

Porter, Monitor Bankruptcy and the Consulting Profession

Although Michael Porter, the strategy guru behind five forces and value chain analysis, may still be busy working on big issues like the rescue of the U.S economy, the fall of Monitor Group this month, the consultancy Porter co-founded back in the 1980s, is stirring up fierce discussions in the business world as well as in the blogsphere.

In the business world, some believed Monitor's bankruptcy has a lot to do with its working relationship to the former Libyan government and its supreme leader Muammar Qadhafi. Others went beyond this, and offered a variety of possible explanations to its demise, including ineffective strategic choice (itself may not believe in five forces etc.), inefficient internal operations, or even too much emphasis on innovation! Yet some took a more value-based view, arguing that it is its customers who are unwilling to buy what the company is selling eventually killed Monitor.

Besides the discussion on Monitor and the gurus behind it, bloggers like the two Freakonomists went one step further. Through their radio channel, Steve Levitt and Stephen Dubner shared their personal views on the consulting profession at large. For the newest profession in the world, there is always skepticism (here and here) and at least somewhat equal forceful voice of defense (here and here). As to me, I always believe in the power of management - not because I am currently involved in it (don't confuse the outcome with the cause), but because of the fact that it is very difficult to explain sustainable competitive advantage* that some company possesses but others don't. Years of research has shown that one potential cause cannot tell the whole story - whether it is at the industry level, the corporate level, or the business unit level, or whether it is due to the structure, the functions or the processes, or whether there are any systematic relationships or it's just completely out of fluke. Many forces are at play. However, the managers of those firms with superior performance have got to get some things right - by choice or by accident, and how they got it right in the first place may exactly reflect the power of management. Just like the fall of Long Term Capital Management isn't the demise of modern finance or the financial industry, the fall of Monitor is also not the death knell of management or the consulting profession. Porter's (as well as many other management gurus') prescription is certainly not a cure-all, because there is always the unexplained, the unexpected or the uncertain. But for management scholars and practitioners, they need to push the current knowledge frontier forward so that the rest of us can learn more and act better.

* For those who doubt the notion of 'sustainable competitive advantage' in the first place, economists and strategy scholars have offered facts and evidence to show that there is such a thing.

In the business world, some believed Monitor's bankruptcy has a lot to do with its working relationship to the former Libyan government and its supreme leader Muammar Qadhafi. Others went beyond this, and offered a variety of possible explanations to its demise, including ineffective strategic choice (itself may not believe in five forces etc.), inefficient internal operations, or even too much emphasis on innovation! Yet some took a more value-based view, arguing that it is its customers who are unwilling to buy what the company is selling eventually killed Monitor.

Besides the discussion on Monitor and the gurus behind it, bloggers like the two Freakonomists went one step further. Through their radio channel, Steve Levitt and Stephen Dubner shared their personal views on the consulting profession at large. For the newest profession in the world, there is always skepticism (here and here) and at least somewhat equal forceful voice of defense (here and here). As to me, I always believe in the power of management - not because I am currently involved in it (don't confuse the outcome with the cause), but because of the fact that it is very difficult to explain sustainable competitive advantage* that some company possesses but others don't. Years of research has shown that one potential cause cannot tell the whole story - whether it is at the industry level, the corporate level, or the business unit level, or whether it is due to the structure, the functions or the processes, or whether there are any systematic relationships or it's just completely out of fluke. Many forces are at play. However, the managers of those firms with superior performance have got to get some things right - by choice or by accident, and how they got it right in the first place may exactly reflect the power of management. Just like the fall of Long Term Capital Management isn't the demise of modern finance or the financial industry, the fall of Monitor is also not the death knell of management or the consulting profession. Porter's (as well as many other management gurus') prescription is certainly not a cure-all, because there is always the unexplained, the unexpected or the uncertain. But for management scholars and practitioners, they need to push the current knowledge frontier forward so that the rest of us can learn more and act better.

* For those who doubt the notion of 'sustainable competitive advantage' in the first place, economists and strategy scholars have offered facts and evidence to show that there is such a thing.

Tuesday, November 13, 2012

Tuesday, October 30, 2012

Ghemawat: the world isn't flat

Strategy guru Pankaj Ghemawat, a long time opponent of "borderless world" or "flat world" view, pulled out some new evidence at TED:

Some cool statistics:

* adding internet traffic to the picture, the ratio of cross-border information flow could go up to 6-7%

Some cool statistics:

- Cross-border information flow (world ratio of foreign to total voice-calling minute): 2%*

- Cross-border people flow (ratio of 1st generation immigrants to world population): 3%

- Cross-border capital flow (ratio of FDI to total investments in the world): 10%

- Cross-border goods/services flow (world exports to GDP ratio): ~20%

* adding internet traffic to the picture, the ratio of cross-border information flow could go up to 6-7%

Thursday, October 11, 2012

Baldness is power?

Where does power come from? Some believe it comes from the critical resources or the access to the resources one has effectively controlled. Others argue that power could originate from one's personalities or certain unique abilities or traits -- such as the ability to compliment or flatter. One recent study is surely pushing the latter explanation to an extreme -- in a rather amusing way -- because it argues that power could also come from baldness.

Albert Mannes of the University of Pennsylvania’s Wharton School (also bald by the way) conducted a series of tests in which the subjects were asked to report their perceptional differences on photos of the same men with and without hair. In all tests, the subjects reported finding the men with shaved heads as more dominant than their hirsute counterparts. More specifically, men with shaved heads are perceived to be more masculine, dominant and, in some cases, to have greater leadership potential.

So does this study suggest that if you want to get yourself promoted, you should go directly to a barber? Not necessarily. One potential catch of this study is that, although baldness may be perceived to be more masculine, dominant and better to lead, it may also relate to one's level of intelligence, IQ, say. More specifically, it might be the case that smarter men could have a higher chance to become bald, particularly after certain years of age. If that's the case, then one's power may come eventually from his inner ability, rather than others' perception on his appearances -- whether tall or short, fat or thin, bald or covered up with hair.

Source: WSJ.

Thursday, August 23, 2012

An ongoing revolution in manufacturing

3D printing may not only change the way we make ordinary products, like a hammer, a toy, or even a stradivarius, it may reshape the industry spectra entirely and completely alter the way how everything is produced, from "growing" human organs to "building" new homes. Below is one example:

Thursday, August 16, 2012

Some thoughts on Toyota Production System

In my last post, I mentioned my trip to Japan to learn the Toyota Production System, but I didn't offer any thoughts on it there. If you still have some interests, here is an article I recently wrote (in Chinese), titled "The Way Out of the Cargo Cult of the Toyota Production System", mainly targeted at Chinese companies. In this short article, I explained why there is a cargo-cult-style learning of TPS in Chinese firms and how to find a way out of it and even make it more suitable to these firms.

Nagoya, Toyota Production System, and Kaizen

I had a trip last month to Nagoya, Japan to get trained in Toyota Production System and its various tools and ramifications. Those lectures were, of course, useful and sometimes inspirational. I was even awed by the smart designs of some parts of Toyota's manufacturing system, like the use of various Kanban cards to coordinate material flows as well as to replenish supplies.

Eventually, I found that these methods and designs are not at all come about at once. Instead, most of them are the results of a methodology that Toyota called "Kaizen", which literally means continuous improvement. Even so, I still found that it's often hard to sustain such efforts to make improvements on some preexisting things over and over again. BUT, as I discovered this (see the pic below), I said to myself, "well, maybe there is nothing on this planet that the Japanese can't make improvements on..."

Eventually, I found that these methods and designs are not at all come about at once. Instead, most of them are the results of a methodology that Toyota called "Kaizen", which literally means continuous improvement. Even so, I still found that it's often hard to sustain such efforts to make improvements on some preexisting things over and over again. BUT, as I discovered this (see the pic below), I said to myself, "well, maybe there is nothing on this planet that the Japanese can't make improvements on..."

Monday, May 7, 2012

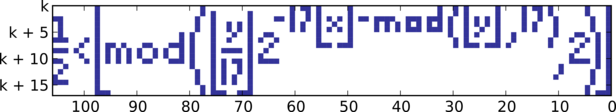

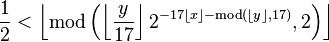

Interesting formula...and graph

Have you seen a mathematical formula, when graphed in two dimensions, can exactly reproduce the formula itself visually? Here is one:

-

,

When proper parameters are chosen for x and y, which at the same time satisfy this inequality, the resulting graph will look like this:

which, as you can see, looks exactly the same as the original formula. Interesting, huh?

See more here. HT: Feng Dong.

Sunday, May 6, 2012

Two books on power & prosperity

One is Why Nations Fail by Daron Acemoglu and James Robinson. In this book, the authors explain why some nations are rich and prosper and others poor and remain so. In contrast to contemporary theories made popular by journalists or economists, their explanation is that, it's neither geography or cultural factors, nor the policy makers' ignorance about what's best for the society as a whole that determine the wealth of nations. Instead, it's the nation's economic and political institutions that matter (in the authors' terms, "inclusive" vs. "extractive" institutions). The authors make the book extremely readable and engaging by using lots of compelling examples and putting together hundreds of years of historical accounts in a coherent and logical manner. Read a couple of book reviews here, here and here, or listen to one of the authors discussing it here.

The other is Private Empire: ExxonMobil and American Power by Steve Coll. Unlike Acemoglu and Robinson's take on power and prosperity from the why perspective and at the national level, Coll's book reveals how power and prosperity can emerge and co-evolve via the private empire building process. Watch the author discussing the book here.

Subscribe to:

Comments (Atom)

,

, denotes the

denotes the